All Categories

Featured

Table of Contents

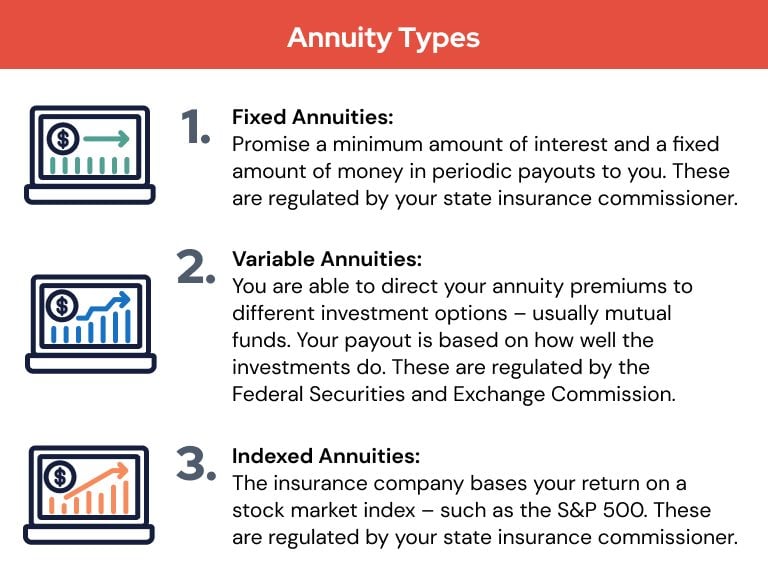

Repaired or variable growth: The funds you contribute to postponed annuities can grow over time., the insurance coverage business sets a particular percent that the account will gain every year.

A variable annuity1, on the various other hand, is usually connected to the financial investment markets. The growth could be greater than you would obtain at a fixed price. But it is not assured, and in down markets the account might shed worth. No. An annuity is an insurance coverage product that can help ensure you'll never ever run out of retired life cost savings.

It's regular to be concerned concerning whether you've saved enough for retired life. Both IRAs and annuities can help alleviate that problem. And both can be made use of to construct a robust retired life strategy. Recognizing the distinctions is key to taking advantage of your cost savings and intending for the retired life you deserve.

Annuities convert existing cost savings right into assured repayments. If you're not certain that your cost savings will certainly last as long as you need them to, an annuity is a great method to lower that issue.

On the other hand, if you're a lengthy method from retired life, beginning an IRA will be helpful. And if you have actually contributed the maximum to your IRA and would certainly such as to place additional cash toward your retirement, a deferred annuity makes sense.

Highlighting What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Pros and Cons of Fixed Index Annuity Vs Variable Annuities Why Fixed Index Annuity Vs Variable Annuities Is a Smart Choice What Is A Variable Annuity Vs A Fixed Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Indexed Annuity Vs Market-variable Annuity FAQs About Fixed Vs Variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Tax Benefits Of Fixed Vs Variable Annuities

When taking into consideration retirement planning, it is very important to discover a method that best fits your lifefor today and in tomorrow. may aid ensure you have the earnings you need to live the life you want after you retire. While taken care of and repaired index annuities audio comparable, there are some essential differences to sort through prior to selecting the appropriate one for you.

is an annuity agreement developed for retired life earnings that ensures a fixed rate of interest rate for a specified amount of time, such as 3%, despite market efficiency. With a fixed rate of interest rate, you know beforehand just how much your annuity will grow and exactly how much revenue it will pay.

The incomes may can be found in set repayments over a set variety of years, fixed repayments for the remainder of your life or in a lump-sum payment. Profits will not be strained till. (FIA) is a sort of annuity agreement developed to create a constant retirement earnings and permit your possessions to expand tax-deferred.

This produces the possibility for more growth if the index executes welland alternatively provides protection from loss because of poor index efficiency. Your annuity's interest is tied to the index's performance, your money is not straight spent in the market. This implies that if the index your annuity is connected to does not do well, your annuity does not shed its worth due to market volatility.

Set annuities have a guaranteed minimum passion price so you will obtain some passion each year. Set annuities might tend to posture much less financial threat than other kinds of annuities and financial investment items whose worths rise and drop with the market.

And with particular sorts of taken care of annuities, like a that fixed rate of interest can be secured with the entire contract term. The passion made in a taken care of annuity isn't impacted by market fluctuations for the duration of the fixed period. Similar to a lot of annuities, if you wish to withdraw money from your repaired annuity earlier than arranged, you'll likely sustain a penalty, or give up chargewhich sometimes can be substantial.

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices What Is Immediate Fixed Annuity Vs Variable Annuity? Features of Smart Investment Choices Why Variable Vs Fixed Annuity Is a Smart Choice Fixed Income Annuity Vs Variable Growth Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Fixed Vs Variable Annuity Pros Cons Who Should Consider Choosing Between Fixed Annuity And Variable Annuity? Tips for Choosing Choosing Between Fixed Annuity And Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Additionally, withdrawals made before age 59 may undergo a 10 percent federal tax obligation fine based on the fact the annuity is tax-deferred. The passion, if any kind of, on a fixed index annuity is connected to an index. Because the passion is connected to a securities market index, the rate of interest attributed will certainly either benefit or experience, based on market performance.

You are trading potentially gaining from market upswings and/or not equaling rising cost of living. Fixed index annuities have the benefit of potentially offering a greater ensured rate of interest price when an index carries out well, and primary security when the index endures losses. In exchange for this defense against losses, there might be a cap on the optimum revenues you can obtain, or your incomes might be restricted to a portion (as an example, 70%) of the index's readjusted worth.

It usually additionally has a current rates of interest as declared by the insurer. Rate of interest, if any, is tied to a specified index, up to a yearly cap. For instance, an item can have an index account where rate of interest is based upon exactly how the S&P 500 Index performs, based on an annual cap.

This feature protects against the threat of market losses. It likewise restricts potential gains, also when the market is up. Passion made is reliant upon index efficiency which can be both positively and adversely influenced. Along with recognizing fixed annuity vs. repaired index annuity differences, there are a couple of other sorts of annuities you may want to discover prior to deciding.

Table of Contents

Latest Posts

Exploring Fixed Vs Variable Annuity Pros And Cons Everything You Need to Know About Annuity Fixed Vs Variable What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement P

Understanding Financial Strategies Everything You Need to Know About Financial Strategies What Is Variable Annuity Vs Fixed Annuity? Pros and Cons of Fixed Annuity Vs Equity-linked Variable Annuity Wh

Highlighting What Is A Variable Annuity Vs A Fixed Annuity Key Insights on Fixed Indexed Annuity Vs Market-variable Annuity What Is Tax Benefits Of Fixed Vs Variable Annuities? Advantages and Disadvan

More

Latest Posts